Tl;dr — The $ACX token is live and ready to claim (Edit: No longer available to claim. All ACX from our airdrop was clawed back as per this Snapshot vote). $ACX is an ERC20 token that controls the Across.to cross-chain bridge. Across connects L2s and rollups to L1 Ethereum, and is secured by UMA’s optimistic oracle. It is optimized for capital efficiency with a single liquidity pool, a competitive relayer landscape, and a no-slippage fee model.

Happy Birthday, Across

It is an honor for the team to present the ACX token to the community, bridgoooors, referrers, influencers, thought leaders, and LPs who helped to build the protocol and its mindshare. Across has been able to make considerable gains in market share, and thanks to Across’ Ranger community, it is now one of the most used bridges in the space.

Here is what the Across.to community has accomplished in the last year:

Over $1 billion in volume since launch

A community of over 50,000 members

A $334MM referral network program

Last 3 months average transfer time of 2.5 minutes

Base bridge fee of 5 bips (.05 %)

Largest ETH transfer — 1000 ETH

Largest USDC transfer — $15,000,000

Across’ market share has been growing consistently, making this an opportune time to mobilize the community with the $ACX token.

The Bridge Ethereum Deserves

Across.to is the bridge that Ethereum deserves because it’s safer and less expensive than competing designs — Across requires less capital and exposes that capital to less risk. It also offers a supreme user experience, with fast fills and a dispute resolution system.

These five design elements are how Across achieves this:

Capital Efficiency

Capital has a cost. If your bridge requires less capital to operate, it will be less expensive. We think that TVL is the wrong metric for a bridge, and this is why we continuously optimize Across for maximum capital efficiency.

One Big Pool

LPs only deposit on ETH mainnet. Across dynamically rebalances liquidity between spoke (L1) and hub (L2) pools. Automatic rebalances mean funds are where they should be at all times, and that users do not need to pay for the arbitrage tax that other bridges implicitly charge.

Fast Fills

Blockchains like Ethereum have “finality” confirmation periods — meaning bridging assets can be constrained by this delay. To sidestep this limitation, Across incentivizes 3rd party “relayers” to complete bridge transactions. These relayers can choose to move funds far faster than Ethereum’s finality times, allowing for fast fills while still protecting the protocol and liquidity providers.

Optimistic

Across uses UMA’s optimistic oracle to confirm that transactions on all the chains are correct. If there is a transaction that is incorrect, it will be disputed and resolved by UMA tokenholders. It only requires a single honest actor to detect fraud.

Smarter, not harder

Across checks if there are funds about to pass in opposite directions, and instead keeps them on the chain they are already on. The result is that even less capital is necessary to fulfill user requests.

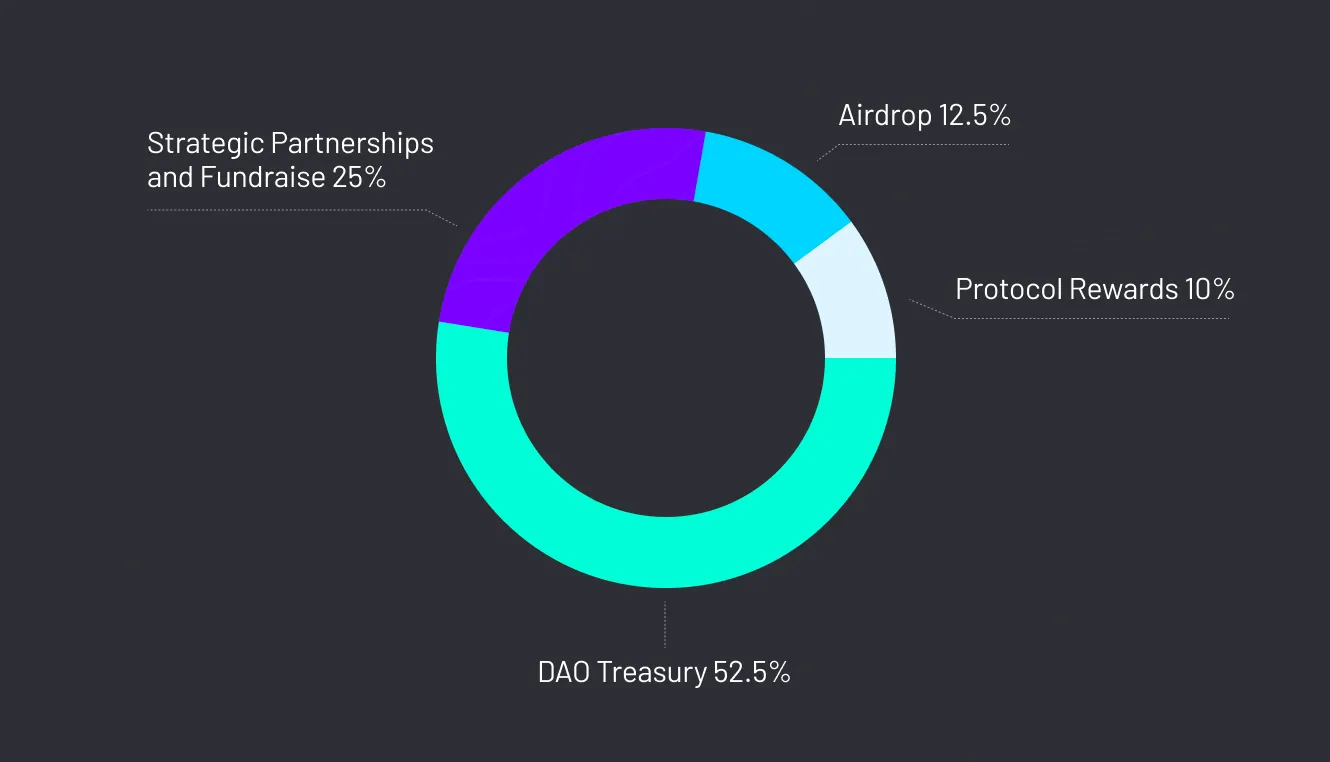

The ACX Tokenomics

1,000,000,000 Across tokens ($ACX) have been minted.

Strategic Partnerships and Fundraise — 25%

These tokens have been allocated for the strategic fundraise and for the token swap with Risk Labs for $UMA tokens. This will give ACX holders a meaningful way to participate in the oracle that secures Across–UMA’s optimistic oracle.

Airdrop — 12.5%

Across’ airdrop has been distributed to community members, bridge liquidity providers, and early bridge users that are responsible for Across’ success.

Protocol Rewards — 10%

These funds will be used to incentivize capital pool liquidity, which will let Across support higher daily volume, as well as for the referral program. The program is built to incentivize loyalty, with staked liquidity tokens earning a reward multiplier.

DAO Treasury — 52.5%

Deploying these funds will be the responsibility of $ACX token holders, who will vote on proposals to benefit the ecosystem.

Vesting and Locking Schedule

Across has raised $10MM in a strategic fundraise using success tokens. They will vest on June 30, 2025 and will not enter circulating supply until then. Their total payout will be between 50MM $ACX and 100MM $ACX. In short, these 100MM $ACX cannot move until the second half of 2025.

Protocol rewards will be distributed gradually over time to the ecosystem as needed to encourage liquidity and other protocol needs.

The airdrop will be claimable immediately and there are strong incentives to stake tokens and maintain loyalty to the protocol.

The DAO treasury makes up over half of the token supply, and these tokens will only be released into circulating supply by a token holder vote. Therefore, we can assume token holders would only do so if they thought the result would be an increase in the value of their holdings in the long run.

ACX holders have immediate ownership of:

Across governance

ACX community treasury

The protocol fee switch — This is an option that tokenholders have to direct a portion of bridge fees towards $ACX holders.

Team assignment switch — This is the option to choose the controlling address for Across parameters, which is currently assigned to Risk Labs, the foundation supporting Across.

Addresses

Ethereum: 0x44108f0223A3C3028F5Fe7AEC7f9bb2E66beF82F

Optimism: 0xFf733b2A3557a7ed6697007ab5D11B79FdD1b76B

Arbitrum: 0x53691596d1BCe8CEa565b84d4915e69e03d9C99d

Boba: 0x96821b258955587069F680729cD77369C0892B40

Polygon: 0xF328b73B6c685831F238c30a23Fc19140CB4D8FC

Are you Locked-and-Long ACX?

If you have earned an airdrop, you can claim it here (Edit: No longer available to claim. All ACX from our airdrop was clawed back as per this Snapshot vote). You will notice that claiming automatically pools and stakes your $ACX, so they are earning rewards and incrementing your reward multiplier. You can unstake those tokens at any time. However, you may not want to.

If you have locked your $ACX airdrop without withdrawing, you are what the community calls “Locked and Long.” Holding this position on-chain will signal loyalty to the $ACX token holder community, and might be considered by the DAO as an important indicator of someone’s relationship to the protocol.

In order to memorialize this, there will be a special NFT given away to everyone who stakes their airdrop for 100 days and earns the 3x APY multiplier. You must claim and stake your tokens by December 15 to qualify, then keep them staked until they reach the 100-day maximum reward level.

For Bridge Travelers and general airdrop recipients, this means claiming and staking your earned $ACX. The NFT will also be awarded to those who earned referral rewards before token launch, and who do not claim them by the snapshot date.

Thank you

The only reason that Across has achieved the position that it holds today is because of the Across community of users and evangelists. We are honored to be part of this transition from being a strong community to being a token holding DAO, operating permissionless, decentralized technology.

If we get this tech right today, our grandchildren will be using it. Thanks for being a part of that journey.

Across Protocol is an intents-based interoperability protocol, capable of filling and settling cross-chain intents. It is made up of the Across Bridge, a powerfully efficient cross-chain transfer tool for end users, Across+, a chain abstraction tool that utilizes cross-chain bridge hooks to fulfill user intents and Across Settlement, a settlement layer for all cross-chain intent order flow. As the multichain economy continues to evolve, intents-based settlement is the key to solving interoperability and Across is at the core of its execution.